Amazon Starts Charging Sales Tax to Ohio Consumers

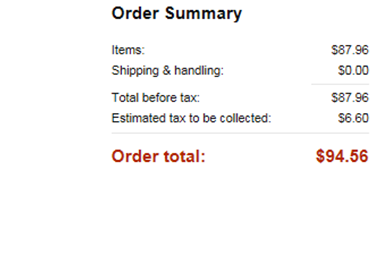

Amazon announced that it will start collecting sales tax on online purchases shipped to Ohio starting today, June 1st, as a result of building three data centers near Columbus that are expected to create 1,000 jobs over the next few years. Brick and mortar stores have long complained that Amazon held a competitive advantage because they were not required to collect sales taxes on purchases shipped to Ohio since the retail giant did not have a physical presence in the state. The nearest distribution centers to Ohio are located in neighboring states (Indiana, Kentucky and Pennsylvania) and Amazon does not have any corporate offices in Ohio. Amazon’s decision to start collecting sales tax creates a level playing field between the online retailer and local businesses around Ohio that have often served as showrooms where potential customers would often inspect the products in person only to buy them through Amazon to avoid paying sales tax.

Even though Ohio customers weren’t paying sales tax on Amazon purchases in the past doesn’t mean the purchases were tax-free. The Ohio Department of Taxation states on their website “Ohio law requires residents to pay the use tax on untaxed purchases made from an internet or catalog (remote) vendor.” Use tax is often reported on Line 19 of the Ohio Individual Income Tax Return (IT 1040). The form also requires filers to certify that no sales or use tax is due, if true, by checking a box. For more information on reporting unpaid use tax, please consult an ARM tax advisor.